- Tuesday Lowdown

- Posts

- Tuesday Lowdown, issue no 5

Tuesday Lowdown, issue no 5

Finally! Some warmer weather! Here’s this week’s issue!

🐢Slow Down

📈How to Buy a House in 2025

🔋Battery Farm?

🥾Boots & Shoes

🐢Slow Down

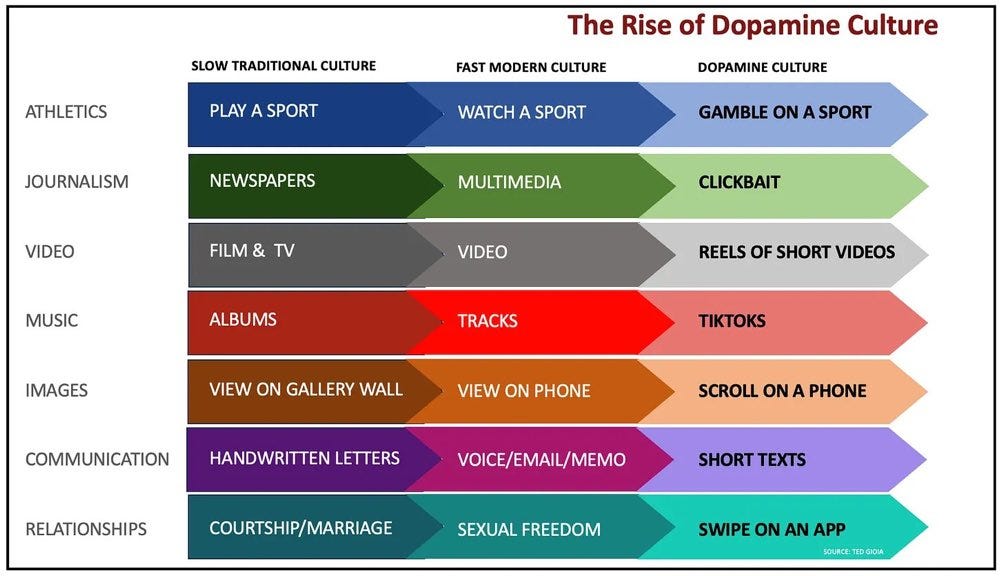

This article is written from a tech/business perspective but worth reading. It makes me think about what I’m doing and reminds me that I get a lot more out of everything on the left side of this chart than on the right.

It’s a long, off-topic article for most, but it's worth reading.

📈How to Buy a House in 2025 Part 3

Assessing Your Finances: Knowing What You Can Spend and Budgeting the Right Way

Before you start scrolling through listings and picturing your dream home, the first and most important step is understanding your finances. Knowing what you can comfortably afford—not just what a lender says you can qualify for—is key to making an intelligent and stress-free home purchase.

Step 1: Take an Honest Look at Your Finances

Start by reviewing your income, savings, and monthly expenses. Look at your bank statements, credit card bills, and any outstanding debts to get a complete picture of where your money is going. A good rule of thumb is that your monthly housing costs (mortgage, taxes, insurance) should not exceed 28-30% of your gross income. However, everyone’s situation is different, and it’s essential to consider your lifestyle and financial goals when setting a budget.

Step 2: Understand the True Costs of Homeownership

Owning a home goes beyond just making a mortgage payment. Be sure to account for costs like:

• Property taxes and homeowners insurance

• Maintenance and repairs (a good rule is to budget 1-2% of the home’s value annually)

• Utility costs, which can be higher than what you’re used to if you’re moving from a rental

• Unexpected expenses—because they always happen!

Step 3: Determine What You’re Comfortable Spending

Getting caught up in what lenders say you can afford is easy, but just because you qualify for a certain amount doesn’t mean you should spend it all. Consider your long-term financial goals, such as retirement savings, travel, or other major expenses. The goal is to own a home and enjoy your life—not to feel house-poor.

By properly assessing your finances, you can set a realistic budget to buy with confidence and peace of mind.

🔋Battery Farm?

A developer is trying to build a battery farm in Granby, but some residents aren’t happy. My take? We need a lot more of these. Solar panel technology increases in efficiency every year. In the not-too-distant future, we’ll be able to generate enough to start tapering off fossil fuels for our energy needs. But our electrical grid is not set up to store the excess generated during the day. What do you think?

🥾Boots & Shoes *Nerd Alert*

I needed a decent pair of boots this fall and might have gone overboard with the research… I’m not going to bore you with link after link of “cool” handcrafted boot makers, but if you’re in the market, let me know, and I’ll fill your email with more than you’ll ever want to know. I can’t make it to this event, but you should!

Thanks again!

Mike